business

$10m World Bank Grant at Risk Amid Nigeria’s Audit Failures

Nigeria at Risk of Losing $10 Million World Bank Funding Over Project Delays and Audit Failures

Nigeria could lose $10 million from a World Bank credit facility by June 30, 2025, due to missed project milestones, substandard audit reports, and delays in rolling out key digital platforms. The warning was issued in a recent restructuring document sent by the World Bank to the Federal Ministry of Finance.

The funds are part of the $103 million Fiscal Governance and Institutions Project (FGIP)—a World Bank initiative under the International Development Association (IDA) aimed at improving Nigeria’s revenue generation, fiscal transparency, and public financial accountability. However, as the project nears its closing date, several critical components remain unfulfilled.

Audit Failures Lead to Funding Cuts

A major setback stems from the incomplete revenue assurance audits of the Federal Inland Revenue Service (FIRS) and Nigeria Customs Service (NCS) for the years 2018 to 2021. The audit reports submitted failed to meet international standards and were rejected by an independent verification agent. As a result, $4 million allocated for this audit has been cancelled.

Additionally, the Ministry of Finance has requested the cancellation of $10.4 million in project funds—$0.9 million earmarked for unused technical assistance and $9.5 million tied to unmet performance-based conditions, including the flawed audits.

Missed Digital Transformation Targets

The World Bank also flagged the failure to launch the National Budget Portal, a key tool intended to enhance budget transparency for the Federal Government and at least 20 states. Despite receiving $1 million in funding, the portal was never deployed.

Delays have also plagued the Revenue Assurance and Billing System (RABS). Although $4.5 million was allocated to the initiative, only 27 out of 55 Federal Government-Owned Enterprises (FGOEs) have established Treasury Single Account (TSA) sub-accounts for foreign revenue earnings—falling short of the project’s goals. Complications related to contract execution, vendor disputes, and indemnity issues raised by the Central Bank of Nigeria have pushed RABS’s projected completion to August 2025—two months after the FGIP’s scheduled closure.

Mixed Outcomes and Unmet Goals

Despite the challenges, the project has yielded some positive outcomes. Non-oil revenue in 2024 reached 153% of its budgeted target, a significant jump from 64.9% in 2018. This improvement is credited to reforms such as exchange rate unification, the TaxProMax automation system, and stronger revenue performance from federal ministries and agencies.

The FGIP also exceeded its target for fiscal data transparency by publishing 10 reconciled fiscal datasets—surpassing the goal of six. However, other benchmarks remain unmet. Capital expenditure execution is at 50%, below the 65% target, and the World Bank has rated the project’s monitoring and evaluation systems as “moderately unsatisfactory.”

Call for Urgent Reform

The potential loss of $10 million highlights deeper structural challenges in Nigeria’s public finance management, including weak audit standards, poor oversight, and sluggish project delivery. While gains in revenue collection and transparency are commendable, the broader reform agenda risks being undermined unless these systemic issues are urgently addressed.

To fully benefit from international development financing and ensure long-term impact, experts stress the need for Nigeria to strengthen its audit mechanisms, enhance project execution capacity, and invest in resilient institutions capable of delivering reform at scale.

business

Discover Life-Changing Digital Products You Can Buy on Selar Today

In today’s fast-paced world, knowledge truly is power. The people who thrive are those who continuously invest in themselves. Whether you want to learn a new skill, start a side hustle, improve your finances, or build a healthier lifestyle, the right digital product can open doors to opportunities you never imagined.

That’s why millions of smart people across Africa and beyond are choosing Selar—one of the largest digital product marketplaces. From ebooks, online courses, masterclasses, templates, business blueprints, and more, Selar gives you access to tools that can transform your life.

Why You Should Invest in Digital Products

-

Instant Access – No waiting, no shipping delays. Get your product immediately and start applying what you learn today.

-

Affordable Learning – Instead of wasting years figuring things out, you can gain insights directly from experts who have already succeeded.

-

Proven Results – Every product is created by professionals with strategies and methods that have worked for them—and will work for you too.

-

Lifetime Value – Buy once and keep coming back. You can re-learn, refresh, and apply the knowledge whenever you need it.

Who Needs These Digital Products?

These products are designed for:

-

Business owners who want to increase sales, attract more customers, and scale their operations.

-

Students and young professionals looking to master in-demand skills like digital marketing, UI/UX design, forex trading, or freelancing.

-

Entrepreneurs eager to discover profitable side hustle opportunities.

-

Anyone who wants to grow in health, wealth, and personal development.

How to Get Started on Selar

-

Choose a Product – Below is a carefully selected list of high-value digital products that have helped thousands of people.

-

Click the Link – Each product includes a direct link to purchase securely via Selar.

-

Start Learning & Applying – You’ll gain instant access so you can begin your journey right away.

Recommended Digital Products You Can Buy Today

Here are some of the top digital products available now:

-

Digital Marketing Made Simple

Get it on Selar -

Affiliate Marketing Simplified

Get it on Selar -

Rare Easiest Affiliate Marketing Blueprint (REAMB)

Get it on Selar -

The Top Level Video Editing Masterclass

Get it on Selar -

Crypto Profit Kit

Get it on Selar -

Beginners & Advanced Crypto Training

Get it on Selar -

Mini Beginners’ Course on Cryptocurrency Investment

Get it on Selar -

Online IELTS Training Pro Edition (2022–)

Get it on Selar -

Ghostwriting Income Generator

Get it on Selar -

Ghostwriting Income Network

Get it on Selar -

Ghostwriting Money Magnet (GMM)

Get it on Selar -

7-Figure Meta Ads Academy

Get it on Selar -

Simplified Online Survey Guide (Get Paid in Pounds)

Get it on Selar -

Affiliate of Affiliate Marketing Sales Secret (AMSS)

Get it on Selar -

Life of Options Program (LOOP)

Get it on Selar -

Profitable Freelancing Academy

Get it on Selar -

Mobile Videography Course: Create Quality Videos with Your Phone

Get it on Selar -

Trade Like TonySnip3r

Get it on Selar

Final Thoughts

Investing in the right digital products can change your life, career, and finances. Instead of spending years figuring things out on your own, you can leverage the wisdom of experts and start seeing results faster.

Don’t wait—take action today. Each product listed above is designed to equip you with skills, knowledge, and opportunities that will continue to pay off for years to come.

business

Discover Life-Changing Digital Products You Can Buy Today on Selar

In today’s world, knowledge is power—and the people who succeed are those who invest in themselves. Whether it’s learning a new skill, starting a side hustle, improving your finances, or building a healthier lifestyle, the right digital product can open doors to opportunities you never imagined.

That’s why millions of smart people across Africa and beyond are turning to Selar, one of the biggest marketplaces for digital products—from ebooks, online courses, masterclasses, templates, to business blueprints and more.

Why You Need These Digital Products

- Instant Access – No waiting, no shipping. Buy now and start learning or applying immediately.

- Affordable Investment – Instead of spending years figuring things out, you can learn from experts who’ve already succeeded.

- Proven Results – These products are created by professionals who have tested strategies and methods that actually work.

- Lifetime Value – Once you purchase, you can always come back, re-learn, and apply the knowledge again and again.

Who Can Benefit from These Products?

- Business owners who want to grow sales, attract more customers, and scale faster.

- Students and young professionals looking to learn in-demand skills like digital marketing, UI/UX, forex, or freelancing.

- Entrepreneurs searching for side hustle opportunities to increase income.

- Anyone who wants to improve in health, wealth, and personal development.

How to Get Started

- Choose a Product Below – I have carefully selected high-value digital products that have helped thousands of people.

- Click the Link – Each product has a direct link to purchase securely through Selar.

- Start Learning & Applying – You’ll receive instant access so you can begin right away.

Recommended Digital Products You Should Buy Today

(This is where you will list your affiliate product links with a short description for each, for example:)

- Digital Marketing made Simple

https://selar.com/p/19b4zi?affiliate=8fpr

- Affiliate Marketing Simplified

https://selar.com/p/323311?affiliate=emzc

- Rare Easiest Affiliate Marketing Blueprint (REAMB)

https://selar.com/p/1482w7?affiliate=n3bz

- The Top Level Video Editing Masterclass

https://selar.com/p/8yi8?affiliate=9agp

- Crypto Profit Kit

https://selar.com/p/ejtf?affiliate=kjn7

- Beginners and Advanced Crypto

http://Womenincrypto.selar.com/oqgd?affiliate=9cjc

- Mini Beginners Course to Invest in Crypto Currency

https://selar.com/p/jsn1?affiliate=8lyn

- Online IELTS Training PRO Edition (2022-)

https://selar.com/p/9v47?affiliate=rodi

- Ghostwriting Income Generator

http://dangig.selar.com/qelh?affiliate=gxd5

- Ghostwriting Income Network

http://coachannieg.selar.com/1m51b8468h?affiliate=mivc

- Ghostwriting Money Magnet(GMM)

http://olaleregmm.selar.com/g84813?affiliate=3646

- 7 Figure Meta Ads Academy

https://selar.com/p/6h15b7?affiliate=ccze

- Simplified Online Survey Guide (GET PAY IN POUNDS)

https://selar.com/p/7210p5?affiliate=mwt8

- Affiliate of Affiliate Marketing Sales Secret (AMSS)

http://victornathel.selar.com/k4gk?affiliate=iqxg

- Life Of Options Program (LOOP)

https://selar.com/p/yotn?affiliate=co2u

- Profitable Freelancing Academy

https://selar.com/p/4163r7?affiliate=s8ba

- Mobile Videography Course: Learn How to Create Quality Videos with your Phone

https://selar.com/p/k7xi?affiliate=tpwp

- Trade Like TONYSNIP3R

https://selar.com/p/i02p3k?affiliate=s25x

Final Thoughts

Investing in the right digital products can transform your life, career, and finances. Instead of wasting years trying to figure things out, you can leverage the experience of experts and start seeing results immediately.

Take action today by choosing from the products above. Each one is designed to equip you with skills, knowledge, and opportunities that will pay off for years to come.

business

We are Hiring: Social Media Growth Ambassadors (2 Positions)

Remote | Part-Time or Flexible Hours

Are you active on social media and passionate about business, jobs, and opportunities?

Do you know how to attract attention, spark engagement, and drive traffic online?

Then this opportunity is for you!

Role Overview:

We are looking for 2 dynamic individuals to serve as Social Media Growth Ambassadors for GlobabizEmpire.com — a trusted online platform for global jobs, business insights, and income opportunities.

Key Responsibilities:

-

Promote GlobabizEmpire.com consistently on Facebook, Instagram, WhatsApp, TikTok, or X

-

Share daily job updates, business news, and smart money tips from the website

-

Drive website traffic using content, trends, reels, and referral links

-

Respond to DMs/comments and convert viewers into website visitors

-

Provide weekly reports on reach, impressions, and traffic performance

What You’ll Need:

-

A strong presence on social media (min. 2,500 followers on at least one platform)

-

Great communication skills and social media creativity

-

Consistency and accountability

-

Passion for helping people grow their careers or income

What You’ll Get:

-

Monthly stipend + performance-based bonus

-

Opportunity to grow your personal brand with us

-

Free digital training + content materials

-

Certificate of Digital Advocacy (upon successful campaign)

How to Apply:

Send us a message with:

-

Your full name

-

Link to your active social media profiles

-

Short message on why you are the perfect fit

-

Screenshot of your past engaging post (if available)

Email: [email protected]

WhatsApp: +234 8153507382

Deadline: August 22, 2025

-

jobs9 months ago

jobs9 months agoEnvironmental Health & Safety (EHS) Specialist – Oando Plc

-

business7 months ago

business7 months agoSEC Director-General to Headline Comercio Partners’ Forum on Global Trade and Innovation Trends

-

news7 months ago

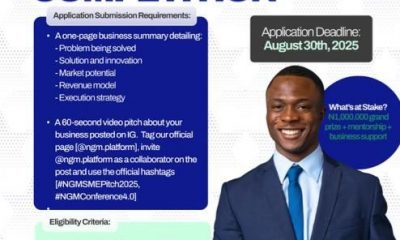

news7 months agoPitch to Win ₦1M! Apply Now for SME Competition 4.0

-

news7 months ago

news7 months agoApply Now: Pivot Challenge 2025 – Up to ₦50 Million Grant & Business Support for Young Nigerian Entrepreneurs

-

news7 months ago

news7 months agoApply Now: 2025 NNPC/SNEPCo Scholarship Worth ₦250,000

-

news7 months ago

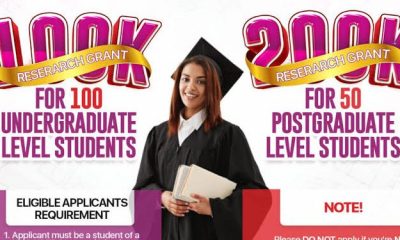

news7 months agoApply Now: Grooming Centre ₦20M Grants for Nigerian Undergraduates & Postgraduates

-

business8 months ago

business8 months agoFG Approves Policy Allowing Ministries to Approve PPP Projects Under ₦20 Billion

-

news7 months ago

news7 months agoApply Now: GET Compass Grant Program – Up to ₦150 Million for Nigerian MSMEs