business

NCDMB Launches Content Fund Certificate, Disburses $400M to 130 Nigerian Companies

NCDMB Launches Nigerian Content Fund Certificate, Disburses $400M to 130 Local Firms

The Nigerian Content Development and Monitoring Board (NCDMB) has unveiled the Nigerian Content Fund Clearance Certificate (NCFCC)—a new mandatory compliance requirement for operators and contractors in Nigeria’s oil and gas sector. The announcement was made at a stakeholder sensitization workshop held in Lagos, where the Board also introduced an upgraded Nigerian Content Development Fund (NCDF) payment portal and a revamped Community Contractors Finance Scheme.

The NCFCC is now a prerequisite for contract bidding, project approval, and certification within the oil and gas industry. This initiative enforces Section 104 of the Nigerian Oil and Gas Industry Content Development (NOGICD) Act, which mandates that upstream companies contribute 1% of every contract value to the NCDF. These contributions fund initiatives that promote indigenous participation and capacity development across the oil and gas value chain.

$400 Million in Local Support

At the event, NCDMB revealed that over 130 indigenous companies have already accessed financing from the $400 million Nigerian Content Intervention Fund (NCI Fund). The Fund—managed in collaboration with the Bank of Industry (BOI) and the Nigerian Export-Import Bank (NEXIM)—provides low-interest loans to qualified oil service providers to enhance competitiveness and drive economic development.

NCDMB Executive Secretary, Engr. Felix Omatsola Ogbe, noted that the introduction of the NCFCC and the digital platform upgrades would enhance transparency, improve access to finance, and streamline compliance for both indigenous and grassroots contractors.

“This initiative reflects our renewed commitment to strengthening local content, improving regulatory oversight, and facilitating funding access,” Ogbe said.

Representing the Executive Secretary, Mr. Mubaraq Zubair, Acting Director of Finance and Personnel Management, explained that the new NCDF portal enables real-time verification of remittances and expedites approval timelines. He added that the revised Community Contractors Scheme was developed alongside banks to boost financial inclusion at the grassroots level.

“We’ve eliminated key access barriers by partnering with banks like FCMB to bring funding closer to underserved communities,” Zubair said.

Key Features of the New Certificate

Dr. Ayebatonye Epemu, Supervisor of Planning and Policy at NCDMB, clarified that the NCFCC is now compulsory for all upstream companies, consultants, and vendors. Issued through the NOGIC-JQS portal, the certificate is valid for 12 months and takes 14 working days to process.

Disbursement Performance & Financing Options

According to Mr. Gabriel Yemilade, Group Head of Oil and Gas at BOI, over $348.3 million and ₦48.3 billion have been disbursed to 79 Nigerian firms in areas such as modular refining, marine logistics, fabrication, and gas processing. He added that the fund has grown from $200 million in 2017 to $300 million by 2020, reflecting the growing demand for indigenous financing.

BOI also manages the Community Contractors Scheme, offering loans of up to ₦100 million at 8% annual interest, secured through contracts or Standing Payment Orders (ISPOs).

From the banking sector, Mr. Akintomide James, Head of Midstream & Dealers at FCMB, highlighted the bank’s role in managing a ₦50 billion facility under the revised community scheme. FCMB will provide vendor financing, invoice discounting, and asset acquisition support to registered local contractors.

NEXIM Bank’s Mr. Mohammed Awami introduced two new funding windows worth $50 million, including a $30 million General Facility and a $20 million Women in Oil and Gas Programme. These funds will support equipment leasing, working capital, and contract execution, with a strong emphasis on economic inclusion and gender diversity.

Addressing Access Barriers

Despite impressive disbursement volumes, challenges persist. Fateemah Mohammed, GM of NCDF (represented by Mr. Erefagha Turner), reported that only 30.47% of applicants qualified for loans under BOI-managed schemes, largely due to documentation and collateral constraints.

“Between January 2024 and May 2025, disbursement volumes rose by 11.43%, and naira value grew by 21.06%, but access challenges remain,” she noted.

To tackle these barriers, the Board plans to simplify application processes, expand awareness campaigns, and introduce more flexible security requirements—especially for women and community-based entrepreneurs.

business

Discover Life-Changing Digital Products You Can Buy on Selar Today

In today’s fast-paced world, knowledge truly is power. The people who thrive are those who continuously invest in themselves. Whether you want to learn a new skill, start a side hustle, improve your finances, or build a healthier lifestyle, the right digital product can open doors to opportunities you never imagined.

That’s why millions of smart people across Africa and beyond are choosing Selar—one of the largest digital product marketplaces. From ebooks, online courses, masterclasses, templates, business blueprints, and more, Selar gives you access to tools that can transform your life.

Why You Should Invest in Digital Products

-

Instant Access – No waiting, no shipping delays. Get your product immediately and start applying what you learn today.

-

Affordable Learning – Instead of wasting years figuring things out, you can gain insights directly from experts who have already succeeded.

-

Proven Results – Every product is created by professionals with strategies and methods that have worked for them—and will work for you too.

-

Lifetime Value – Buy once and keep coming back. You can re-learn, refresh, and apply the knowledge whenever you need it.

Who Needs These Digital Products?

These products are designed for:

-

Business owners who want to increase sales, attract more customers, and scale their operations.

-

Students and young professionals looking to master in-demand skills like digital marketing, UI/UX design, forex trading, or freelancing.

-

Entrepreneurs eager to discover profitable side hustle opportunities.

-

Anyone who wants to grow in health, wealth, and personal development.

How to Get Started on Selar

-

Choose a Product – Below is a carefully selected list of high-value digital products that have helped thousands of people.

-

Click the Link – Each product includes a direct link to purchase securely via Selar.

-

Start Learning & Applying – You’ll gain instant access so you can begin your journey right away.

Recommended Digital Products You Can Buy Today

Here are some of the top digital products available now:

-

Digital Marketing Made Simple

Get it on Selar -

Affiliate Marketing Simplified

Get it on Selar -

Rare Easiest Affiliate Marketing Blueprint (REAMB)

Get it on Selar -

The Top Level Video Editing Masterclass

Get it on Selar -

Crypto Profit Kit

Get it on Selar -

Beginners & Advanced Crypto Training

Get it on Selar -

Mini Beginners’ Course on Cryptocurrency Investment

Get it on Selar -

Online IELTS Training Pro Edition (2022–)

Get it on Selar -

Ghostwriting Income Generator

Get it on Selar -

Ghostwriting Income Network

Get it on Selar -

Ghostwriting Money Magnet (GMM)

Get it on Selar -

7-Figure Meta Ads Academy

Get it on Selar -

Simplified Online Survey Guide (Get Paid in Pounds)

Get it on Selar -

Affiliate of Affiliate Marketing Sales Secret (AMSS)

Get it on Selar -

Life of Options Program (LOOP)

Get it on Selar -

Profitable Freelancing Academy

Get it on Selar -

Mobile Videography Course: Create Quality Videos with Your Phone

Get it on Selar -

Trade Like TonySnip3r

Get it on Selar

Final Thoughts

Investing in the right digital products can change your life, career, and finances. Instead of spending years figuring things out on your own, you can leverage the wisdom of experts and start seeing results faster.

Don’t wait—take action today. Each product listed above is designed to equip you with skills, knowledge, and opportunities that will continue to pay off for years to come.

business

Discover Life-Changing Digital Products You Can Buy Today on Selar

In today’s world, knowledge is power—and the people who succeed are those who invest in themselves. Whether it’s learning a new skill, starting a side hustle, improving your finances, or building a healthier lifestyle, the right digital product can open doors to opportunities you never imagined.

That’s why millions of smart people across Africa and beyond are turning to Selar, one of the biggest marketplaces for digital products—from ebooks, online courses, masterclasses, templates, to business blueprints and more.

Why You Need These Digital Products

- Instant Access – No waiting, no shipping. Buy now and start learning or applying immediately.

- Affordable Investment – Instead of spending years figuring things out, you can learn from experts who’ve already succeeded.

- Proven Results – These products are created by professionals who have tested strategies and methods that actually work.

- Lifetime Value – Once you purchase, you can always come back, re-learn, and apply the knowledge again and again.

Who Can Benefit from These Products?

- Business owners who want to grow sales, attract more customers, and scale faster.

- Students and young professionals looking to learn in-demand skills like digital marketing, UI/UX, forex, or freelancing.

- Entrepreneurs searching for side hustle opportunities to increase income.

- Anyone who wants to improve in health, wealth, and personal development.

How to Get Started

- Choose a Product Below – I have carefully selected high-value digital products that have helped thousands of people.

- Click the Link – Each product has a direct link to purchase securely through Selar.

- Start Learning & Applying – You’ll receive instant access so you can begin right away.

Recommended Digital Products You Should Buy Today

(This is where you will list your affiliate product links with a short description for each, for example:)

- Digital Marketing made Simple

https://selar.com/p/19b4zi?affiliate=8fpr

- Affiliate Marketing Simplified

https://selar.com/p/323311?affiliate=emzc

- Rare Easiest Affiliate Marketing Blueprint (REAMB)

https://selar.com/p/1482w7?affiliate=n3bz

- The Top Level Video Editing Masterclass

https://selar.com/p/8yi8?affiliate=9agp

- Crypto Profit Kit

https://selar.com/p/ejtf?affiliate=kjn7

- Beginners and Advanced Crypto

http://Womenincrypto.selar.com/oqgd?affiliate=9cjc

- Mini Beginners Course to Invest in Crypto Currency

https://selar.com/p/jsn1?affiliate=8lyn

- Online IELTS Training PRO Edition (2022-)

https://selar.com/p/9v47?affiliate=rodi

- Ghostwriting Income Generator

http://dangig.selar.com/qelh?affiliate=gxd5

- Ghostwriting Income Network

http://coachannieg.selar.com/1m51b8468h?affiliate=mivc

- Ghostwriting Money Magnet(GMM)

http://olaleregmm.selar.com/g84813?affiliate=3646

- 7 Figure Meta Ads Academy

https://selar.com/p/6h15b7?affiliate=ccze

- Simplified Online Survey Guide (GET PAY IN POUNDS)

https://selar.com/p/7210p5?affiliate=mwt8

- Affiliate of Affiliate Marketing Sales Secret (AMSS)

http://victornathel.selar.com/k4gk?affiliate=iqxg

- Life Of Options Program (LOOP)

https://selar.com/p/yotn?affiliate=co2u

- Profitable Freelancing Academy

https://selar.com/p/4163r7?affiliate=s8ba

- Mobile Videography Course: Learn How to Create Quality Videos with your Phone

https://selar.com/p/k7xi?affiliate=tpwp

- Trade Like TONYSNIP3R

https://selar.com/p/i02p3k?affiliate=s25x

Final Thoughts

Investing in the right digital products can transform your life, career, and finances. Instead of wasting years trying to figure things out, you can leverage the experience of experts and start seeing results immediately.

Take action today by choosing from the products above. Each one is designed to equip you with skills, knowledge, and opportunities that will pay off for years to come.

business

We are Hiring: Social Media Growth Ambassadors (2 Positions)

Remote | Part-Time or Flexible Hours

Are you active on social media and passionate about business, jobs, and opportunities?

Do you know how to attract attention, spark engagement, and drive traffic online?

Then this opportunity is for you!

Role Overview:

We are looking for 2 dynamic individuals to serve as Social Media Growth Ambassadors for GlobabizEmpire.com — a trusted online platform for global jobs, business insights, and income opportunities.

Key Responsibilities:

-

Promote GlobabizEmpire.com consistently on Facebook, Instagram, WhatsApp, TikTok, or X

-

Share daily job updates, business news, and smart money tips from the website

-

Drive website traffic using content, trends, reels, and referral links

-

Respond to DMs/comments and convert viewers into website visitors

-

Provide weekly reports on reach, impressions, and traffic performance

What You’ll Need:

-

A strong presence on social media (min. 2,500 followers on at least one platform)

-

Great communication skills and social media creativity

-

Consistency and accountability

-

Passion for helping people grow their careers or income

What You’ll Get:

-

Monthly stipend + performance-based bonus

-

Opportunity to grow your personal brand with us

-

Free digital training + content materials

-

Certificate of Digital Advocacy (upon successful campaign)

How to Apply:

Send us a message with:

-

Your full name

-

Link to your active social media profiles

-

Short message on why you are the perfect fit

-

Screenshot of your past engaging post (if available)

Email: [email protected]

WhatsApp: +234 8153507382

Deadline: August 22, 2025

-

business6 months ago

business6 months agoSEC Director-General to Headline Comercio Partners’ Forum on Global Trade and Innovation Trends

-

jobs7 months ago

jobs7 months agoEnvironmental Health & Safety (EHS) Specialist – Oando Plc

-

news6 months ago

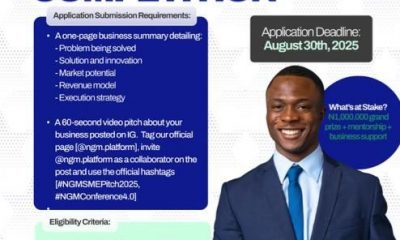

news6 months agoPitch to Win ₦1M! Apply Now for SME Competition 4.0

-

news6 months ago

news6 months agoApply Now: 2025 NNPC/SNEPCo Scholarship Worth ₦250,000

-

news5 months ago

news5 months agoApply Now: Pivot Challenge 2025 – Up to ₦50 Million Grant & Business Support for Young Nigerian Entrepreneurs

-

news6 months ago

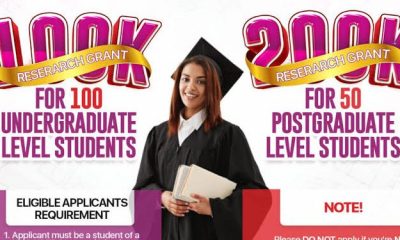

news6 months agoApply Now: Grooming Centre ₦20M Grants for Nigerian Undergraduates & Postgraduates

-

news5 months ago

news5 months agoApply Now: GET Compass Grant Program – Up to ₦150 Million for Nigerian MSMEs

-

business7 months ago

business7 months agoFG Approves Policy Allowing Ministries to Approve PPP Projects Under ₦20 Billion