news

Apply Now: Visa Accelerator Program Cohort 5 – Funding, Mentorship & Exclusive Visa Training

Apply Now: Visa Africa Accelerator Program 2025 – Cohort 5 (Funding, Mentorship & Visa Training)

Visa is now accepting applications for the Africa 2025 Accelerator Program – a transformative opportunity for early-stage startups ready to scale across the continent. If your business has a working MVP or a market-ready solution, this is your chance to gain mentorship, access exclusive training, and secure funding and partnerships that matter.

Who Should Apply?

This program is ideal for:

-

Seed to Series A startups with a functional MVP and demonstrable traction

-

Solutions aligned with Visa’s core financial themes, including:

-

Payments and digital commerce

-

Embedded finance and fintech infrastructure

-

SME empowerment and sustainable finance

-

Payment infrastructure innovation

-

-

Teams based in Africa or with plans to expand within the region

Why Join the Visa Accelerator?

1:1 Mentorship

Get tailored, practical advice from successful founders and seasoned industry professionals who understand your journey.

Exclusive Visa Training

Deepen your fintech expertise with Visa’s developer tools, APIs, and solution-building frameworks. Leverage Visa’s ecosystem to grow confidently.

Expert-Led Curriculum

Access hands-on learning across critical business functions like product design, marketing, finance, and customer acquisition.

Pitch & Fundraising Opportunities

Showcase your startup to leading investors, including Visa, Plug and Play, and other prominent venture capital firms on Demo Day.

Over $200,000 in Perks

Receive exclusive partner credits and service discounts that help reduce startup costs and scale faster.

Strategic Partnerships

Engage with key players in the financial ecosystem to drive meaningful partnerships and long-term growth.

Important Dates

-

Application Deadline: August 15, 2025

Ready to Scale Your Startup?

If you’re building the future of finance in Africa, this is your launchpad.

news

Call for Applications: SDG Innovation Accelerator for Professionals 2026 Cohort

Applications Open for the United Nations 2026 SDG Innovation Accelerator for Professionals

The United Nations Global Compact has announced the opening of applications for the 2026 SDG Innovation Accelerator for Professionals — a nine-month programme designed to empower young professionals to create business-driven solutions that advance the Sustainable Development Goals (SDGs).

This initiative provides a unique opportunity for companies participating in the UN Global Compact to nurture in-house innovators capable of driving sustainability, transformation, and long-term business value.

About the Accelerator

The SDG Innovation Accelerator equips participants with tools and strategies to integrate sustainability into business models, develop innovative solutions, and build leadership capacity.

For African organisations, particularly those expanding their ESG and innovation strategies, the programme offers access to global expertise, collaborative learning, and practical frameworks to transform sustainability goals into measurable business results.

Programme Highlights

-

Duration: February – September 2026

-

Application Window: 15 October 2025 – 31 January 2026

-

Eligibility: Young professionals aged 35 or below employed by companies that are members of the UN Global Compact

-

Commitment: Minimum of 4 hours per month for coursework and attendance at 4 full-day workshops

-

Tracks:

-

In-country cohorts

-

Africa Track (for companies in Egypt and the Indian Ocean region)

-

Global Track (for participants in countries without local Global Compact offices)

-

Participants are expected to be high-performing individuals with a strong interest in sustainability, business innovation, or emerging technologies.

Why It Matters for African Businesses

Across Africa, companies are under increasing pressure to deliver not just profits, but purpose. However, many organisations still lack the internal capacity to innovate around sustainability.

The SDG Innovation Accelerator bridges this gap by equipping young professionals to address real business challenges such as:

-

Climate risk and resilience

-

Circular economy and sustainable production

-

Inclusive business growth

-

Ethical and responsible sourcing

Through participation, companies can strengthen their brand reputation, prepare future leaders, and integrate the SDGs into corporate strategy. Alumni often return with actionable innovations that enhance product design, operational efficiency, and corporate responsibility.

Benefits for Participants

-

Access to global case studies and innovation frameworks

-

Expert-led workshops and hands-on coaching

-

Collaboration with peers from leading international companies

-

Mentorship on sustainability, technology, and leadership

-

Opportunity to develop and pitch real-world business solutions

Benefits for Companies

-

Tailored SDG-focused solutions to key business challenges

-

Strengthened innovation and sustainability culture

-

Structured professional development for emerging leaders

-

Enhanced global recognition through UN Global Compact participation

Tips for a Successful Application

-

Nominate employees already contributing to innovation or sustainability projects

-

Choose candidates capable of representing company priorities and challenges

-

Ensure management support for nominated participants

-

Encourage nominees to identify a sustainability challenge relevant to their company before applying

How to Apply

Only UN Global Compact participant companies are eligible to apply.

To submit an application:

-

Visit the official SDG Innovation Accelerator Programme page

-

Indicate interest during the application window (15 October 2025 – 31 January 2026)

-

Submit nominee details, including professional background and company endorsement

-

Attend the information session on 2 December 2025

-

Await confirmation and onboarding before the programme launch in February 2026

Source: United Nations Global Compact – SDG Innovation Accelerator for Professionals

news

Moniepoint CEO Unveils ₦150 Million Future Builders Fund to Support 14 STEM Students in Nigeria

Moniepoint CEO Launches ₦150 Million Future Builders Fund to Empower STEM Students Across Nigeria

Tosin Eniolorunda, Founder and Chief Executive Officer of Moniepoint, has announced the launch of the Future Builders Fund, a fully-funded scholarship program designed to empower high-potential but under-resourced students across Nigeria pursuing degrees in Science, Technology, Engineering, and Mathematics (STEM).

According to the official statement, this pilot initiative seeks to eliminate the financial and structural barriers that hinder brilliant students from realizing their potential, while also contributing to Nigeria’s growing digital economy and innovation ecosystem.

A Vision for Inclusive Innovation

The Future Builders Fund is an extension of Eniolorunda’s long-standing commitment to education and technology empowerment. His past initiatives include the donation of a ₦100 million CAD/CAM laboratory to Obafemi Awolowo University (OAU) and sponsorship of youth-focused innovation programs such as the University of Lagos Entrepreneurship Challenge, Nigenius Inter-School Robotics Competition, and the NextGen Connect Interschool Oratory Competition — all valued collectively at ₦50 million.

“Every child deserves the opportunity to become the best version of themselves, and socioeconomic barriers should never block the path to brilliance,” Eniolorunda said. “Through the Future Builders Fund, we aim to identify and nurture the innovators who will define Nigeria’s future. This initiative goes beyond financial support — it’s about mentorship, growth, and transformation.”

Programme Structure and Coverage

The Future Builders Fund will initially support 14 outstanding students, with two beneficiaries selected from each of the following seven federal universities across Nigeria’s six geopolitical zones:

-

Obafemi Awolowo University (Ile-Ife)

-

University of Nigeria (Nsukka)

-

University of Calabar

-

University of Abuja

-

Ahmadu Bello University (Zaria)

-

University of Maiduguri

-

University of Lagos

Each selected scholar will receive:

-

Full tuition support

-

On-campus accommodation

-

A brand-new laptop

-

Monthly living stipend

-

Access to mentorship and leadership development programmes focused on building technical expertise and entrepreneurial thinking

Eligibility and Selection Process

Eligible candidates must be 200-level students enrolled in any of the listed universities. Applicants are required to submit:

-

Their bio-data

-

Academic transcripts

-

A personal statement detailing their financial need and career aspirations

Shortlisted applicants will take a standardized aptitude test assessing academic strength, critical thinking, and problem-solving abilities.

The top two candidates from each institution will be awarded the scholarship, renewable annually based on academic performance and demonstrated growth in leadership or technical competence.

Building Nigeria’s Next Generation of Innovators

The Future Builders Fund is part of a five-year pilot initiative that blends financial aid, mentorship, and STEM skill-building to accelerate the rise of Nigeria’s next generation of innovators, inventors, and entrepreneurs.

Through this initiative, Moniepoint is not just investing in education—it is building a future-ready pipeline of young Nigerians equipped to drive the nation’s digital and technological transformation.

news

Apply Now: Fully Funded Sino-Africa Green Finance Alliance (SAGFA) Fellowship 2025

Sino-Africa Green Finance Alliance (SAGFA) Fellowship – Fully Funded

The Sino-Africa Green Finance Alliance (SAGFA) Fellowship is a fully funded professional development program aimed at cultivating African leadership in green finance and sustainable development.

Led by the Africa-China Centre for Policy and Advisory (ACCPA) and supported by the African Climate Foundation (ACF), this fellowship equips professionals in policy, research, and industry with the knowledge and tools to drive sustainable economic transformation across the continent.

About the Fellowship

The SAGFA Fellowship provides specialized training in green finance, climate policy, and sustainable industrial development.

The pilot edition is delivered fully online, ensuring accessibility and flexibility for professionals across Africa. Future cohorts may include in-person residencies and industry immersion as the program expands and attracts additional funding.

Why This Fellowship Matters

As Africa navigates the twin challenges of climate change and industrial transformation, expertise in green finance is increasingly vital. This fellowship bridges the gap by empowering professionals to design, implement, and scale financial mechanisms that promote climate resilience and low-carbon growth.

It nurtures a new generation of leaders who go beyond advocacy to deliver real, finance-driven solutions for sustainable progress.

Eligibility Criteria

The fellowship targets mid- to senior-level professionals, including:

-

Policymakers and government officials

-

Researchers and think-tank analysts

-

Development practitioners and program advisors

-

Finance, energy, manufacturing, and agribusiness leaders

-

Sustainability and investment officers

Applicants should demonstrate a strong commitment to applying green finance principles within their organizations or national contexts.

Program Benefits

-

Fully funded 8-week virtual fellowship

-

Expert-led training and case-based learning

-

Africa-China knowledge exchange and collaboration

-

Capstone project addressing national or sectoral challenges

-

Access to a vibrant alumni network shaping Africa’s climate policy

How to Apply

Professionals passionate about advancing Africa’s green economic transformation are encouraged to apply through the official application portal below:

Source: Africa-China Centre for Policy and Advisory (ACCPA)

-

jobs9 months ago

jobs9 months agoEnvironmental Health & Safety (EHS) Specialist – Oando Plc

-

business7 months ago

business7 months agoSEC Director-General to Headline Comercio Partners’ Forum on Global Trade and Innovation Trends

-

news7 months ago

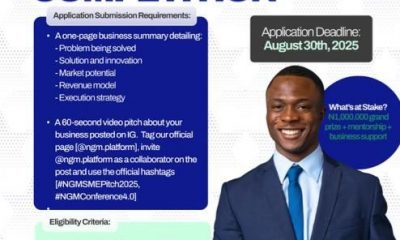

news7 months agoPitch to Win ₦1M! Apply Now for SME Competition 4.0

-

news7 months ago

news7 months agoApply Now: Pivot Challenge 2025 – Up to ₦50 Million Grant & Business Support for Young Nigerian Entrepreneurs

-

news7 months ago

news7 months agoApply Now: 2025 NNPC/SNEPCo Scholarship Worth ₦250,000

-

news7 months ago

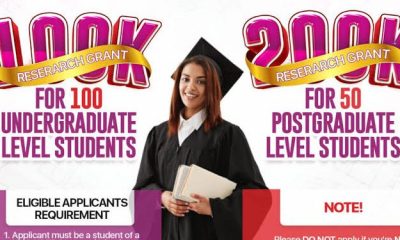

news7 months agoApply Now: Grooming Centre ₦20M Grants for Nigerian Undergraduates & Postgraduates

-

business8 months ago

business8 months agoFG Approves Policy Allowing Ministries to Approve PPP Projects Under ₦20 Billion

-

news7 months ago

news7 months agoApply Now: GET Compass Grant Program – Up to ₦150 Million for Nigerian MSMEs