business

CBN Urges Stronger Cybersecurity as Nigeria Expands Open Banking

CBN Warns Banks and Fintechs: Prioritize Cybersecurity in Nigeria’s Open Banking Push

The Central Bank of Nigeria (CBN) has issued a strong warning to banks and financial technology companies (fintechs), urging them to prioritize cybersecurity as the country accelerates its transition to open banking.

Speaking at the Q2 Regulators Forum hosted by the Fintech Association of Nigeria (FintechNGR), the CBN’s Director of Payments System Policy highlighted that while open banking promises major innovation and customer-centric services, it also presents serious cybersecurity risks if not properly managed.

“Open banking must not become an easy entry point for cybercriminals,” the CBN official cautioned. “We’ve seen global incidents of data breaches. The integrity of our financial systems must be protected at all costs.”

The Promise and the Risk of Open Banking

Open banking enables third-party providers—such as fintechs—to access consumer financial data (like account balances and transaction history) with the user’s consent. This is made possible through application programming interfaces (APIs) that connect banking platforms with external services.

However, the CBN warned that these APIs can become vulnerable points of attack without robust cybersecurity frameworks in place.

Call for Stronger Protections and Customer Education

The CBN urged financial institutions to:

-

Invest heavily in cybersecurity infrastructure

-

Ensure airtight protection of systems and APIs

-

Educate customers about what they’re consenting to and how their data will be used

“We don’t want criminals sending fake messages asking users to share PINs or login details,” the CBN representative said. “Sensitization is critical. Security, privacy, and consumer protection are non-negotiable.”

The regulator emphasized that uninformed customers are more susceptible to phishing attacks and social engineering tactics, especially as cybercriminals could exploit open banking channels for impersonation or fraud.

Standardization and Regulation Underway

To strengthen the ecosystem, the CBN is currently working on API standardization, which will allow fintechs to integrate with banks through a unified protocol, reducing the need for custom configurations across different institutions.

This initiative follows the CBN’s historic release of operational guidelines on March 7, 2023, making Nigeria the first African country to formally adopt open banking regulations. The framework lays out clear rules for how financial data can be accessed and shared—only with user permission.

Balancing Innovation with Security

Open banking is expected to enhance competition, spur innovation, and provide more personalized financial services. However, the CBN maintains that without strong cybersecurity, standardized APIs, and public awareness, the model could backfire and compromise both institutions and consumers.

business

Discover Life-Changing Digital Products You Can Buy on Selar Today

In today’s fast-paced world, knowledge truly is power. The people who thrive are those who continuously invest in themselves. Whether you want to learn a new skill, start a side hustle, improve your finances, or build a healthier lifestyle, the right digital product can open doors to opportunities you never imagined.

That’s why millions of smart people across Africa and beyond are choosing Selar—one of the largest digital product marketplaces. From ebooks, online courses, masterclasses, templates, business blueprints, and more, Selar gives you access to tools that can transform your life.

Why You Should Invest in Digital Products

-

Instant Access – No waiting, no shipping delays. Get your product immediately and start applying what you learn today.

-

Affordable Learning – Instead of wasting years figuring things out, you can gain insights directly from experts who have already succeeded.

-

Proven Results – Every product is created by professionals with strategies and methods that have worked for them—and will work for you too.

-

Lifetime Value – Buy once and keep coming back. You can re-learn, refresh, and apply the knowledge whenever you need it.

Who Needs These Digital Products?

These products are designed for:

-

Business owners who want to increase sales, attract more customers, and scale their operations.

-

Students and young professionals looking to master in-demand skills like digital marketing, UI/UX design, forex trading, or freelancing.

-

Entrepreneurs eager to discover profitable side hustle opportunities.

-

Anyone who wants to grow in health, wealth, and personal development.

How to Get Started on Selar

-

Choose a Product – Below is a carefully selected list of high-value digital products that have helped thousands of people.

-

Click the Link – Each product includes a direct link to purchase securely via Selar.

-

Start Learning & Applying – You’ll gain instant access so you can begin your journey right away.

Recommended Digital Products You Can Buy Today

Here are some of the top digital products available now:

-

Digital Marketing Made Simple

Get it on Selar -

Affiliate Marketing Simplified

Get it on Selar -

Rare Easiest Affiliate Marketing Blueprint (REAMB)

Get it on Selar -

The Top Level Video Editing Masterclass

Get it on Selar -

Crypto Profit Kit

Get it on Selar -

Beginners & Advanced Crypto Training

Get it on Selar -

Mini Beginners’ Course on Cryptocurrency Investment

Get it on Selar -

Online IELTS Training Pro Edition (2022–)

Get it on Selar -

Ghostwriting Income Generator

Get it on Selar -

Ghostwriting Income Network

Get it on Selar -

Ghostwriting Money Magnet (GMM)

Get it on Selar -

7-Figure Meta Ads Academy

Get it on Selar -

Simplified Online Survey Guide (Get Paid in Pounds)

Get it on Selar -

Affiliate of Affiliate Marketing Sales Secret (AMSS)

Get it on Selar -

Life of Options Program (LOOP)

Get it on Selar -

Profitable Freelancing Academy

Get it on Selar -

Mobile Videography Course: Create Quality Videos with Your Phone

Get it on Selar -

Trade Like TonySnip3r

Get it on Selar

Final Thoughts

Investing in the right digital products can change your life, career, and finances. Instead of spending years figuring things out on your own, you can leverage the wisdom of experts and start seeing results faster.

Don’t wait—take action today. Each product listed above is designed to equip you with skills, knowledge, and opportunities that will continue to pay off for years to come.

business

Discover Life-Changing Digital Products You Can Buy Today on Selar

In today’s world, knowledge is power—and the people who succeed are those who invest in themselves. Whether it’s learning a new skill, starting a side hustle, improving your finances, or building a healthier lifestyle, the right digital product can open doors to opportunities you never imagined.

That’s why millions of smart people across Africa and beyond are turning to Selar, one of the biggest marketplaces for digital products—from ebooks, online courses, masterclasses, templates, to business blueprints and more.

Why You Need These Digital Products

- Instant Access – No waiting, no shipping. Buy now and start learning or applying immediately.

- Affordable Investment – Instead of spending years figuring things out, you can learn from experts who’ve already succeeded.

- Proven Results – These products are created by professionals who have tested strategies and methods that actually work.

- Lifetime Value – Once you purchase, you can always come back, re-learn, and apply the knowledge again and again.

Who Can Benefit from These Products?

- Business owners who want to grow sales, attract more customers, and scale faster.

- Students and young professionals looking to learn in-demand skills like digital marketing, UI/UX, forex, or freelancing.

- Entrepreneurs searching for side hustle opportunities to increase income.

- Anyone who wants to improve in health, wealth, and personal development.

How to Get Started

- Choose a Product Below – I have carefully selected high-value digital products that have helped thousands of people.

- Click the Link – Each product has a direct link to purchase securely through Selar.

- Start Learning & Applying – You’ll receive instant access so you can begin right away.

Recommended Digital Products You Should Buy Today

(This is where you will list your affiliate product links with a short description for each, for example:)

- Digital Marketing made Simple

https://selar.com/p/19b4zi?affiliate=8fpr

- Affiliate Marketing Simplified

https://selar.com/p/323311?affiliate=emzc

- Rare Easiest Affiliate Marketing Blueprint (REAMB)

https://selar.com/p/1482w7?affiliate=n3bz

- The Top Level Video Editing Masterclass

https://selar.com/p/8yi8?affiliate=9agp

- Crypto Profit Kit

https://selar.com/p/ejtf?affiliate=kjn7

- Beginners and Advanced Crypto

http://Womenincrypto.selar.com/oqgd?affiliate=9cjc

- Mini Beginners Course to Invest in Crypto Currency

https://selar.com/p/jsn1?affiliate=8lyn

- Online IELTS Training PRO Edition (2022-)

https://selar.com/p/9v47?affiliate=rodi

- Ghostwriting Income Generator

http://dangig.selar.com/qelh?affiliate=gxd5

- Ghostwriting Income Network

http://coachannieg.selar.com/1m51b8468h?affiliate=mivc

- Ghostwriting Money Magnet(GMM)

http://olaleregmm.selar.com/g84813?affiliate=3646

- 7 Figure Meta Ads Academy

https://selar.com/p/6h15b7?affiliate=ccze

- Simplified Online Survey Guide (GET PAY IN POUNDS)

https://selar.com/p/7210p5?affiliate=mwt8

- Affiliate of Affiliate Marketing Sales Secret (AMSS)

http://victornathel.selar.com/k4gk?affiliate=iqxg

- Life Of Options Program (LOOP)

https://selar.com/p/yotn?affiliate=co2u

- Profitable Freelancing Academy

https://selar.com/p/4163r7?affiliate=s8ba

- Mobile Videography Course: Learn How to Create Quality Videos with your Phone

https://selar.com/p/k7xi?affiliate=tpwp

- Trade Like TONYSNIP3R

https://selar.com/p/i02p3k?affiliate=s25x

Final Thoughts

Investing in the right digital products can transform your life, career, and finances. Instead of wasting years trying to figure things out, you can leverage the experience of experts and start seeing results immediately.

Take action today by choosing from the products above. Each one is designed to equip you with skills, knowledge, and opportunities that will pay off for years to come.

business

We are Hiring: Social Media Growth Ambassadors (2 Positions)

Remote | Part-Time or Flexible Hours

Are you active on social media and passionate about business, jobs, and opportunities?

Do you know how to attract attention, spark engagement, and drive traffic online?

Then this opportunity is for you!

Role Overview:

We are looking for 2 dynamic individuals to serve as Social Media Growth Ambassadors for GlobabizEmpire.com — a trusted online platform for global jobs, business insights, and income opportunities.

Key Responsibilities:

-

Promote GlobabizEmpire.com consistently on Facebook, Instagram, WhatsApp, TikTok, or X

-

Share daily job updates, business news, and smart money tips from the website

-

Drive website traffic using content, trends, reels, and referral links

-

Respond to DMs/comments and convert viewers into website visitors

-

Provide weekly reports on reach, impressions, and traffic performance

What You’ll Need:

-

A strong presence on social media (min. 2,500 followers on at least one platform)

-

Great communication skills and social media creativity

-

Consistency and accountability

-

Passion for helping people grow their careers or income

What You’ll Get:

-

Monthly stipend + performance-based bonus

-

Opportunity to grow your personal brand with us

-

Free digital training + content materials

-

Certificate of Digital Advocacy (upon successful campaign)

How to Apply:

Send us a message with:

-

Your full name

-

Link to your active social media profiles

-

Short message on why you are the perfect fit

-

Screenshot of your past engaging post (if available)

Email: [email protected]

WhatsApp: +234 8153507382

Deadline: August 22, 2025

-

jobs9 months ago

jobs9 months agoEnvironmental Health & Safety (EHS) Specialist – Oando Plc

-

business7 months ago

business7 months agoSEC Director-General to Headline Comercio Partners’ Forum on Global Trade and Innovation Trends

-

news7 months ago

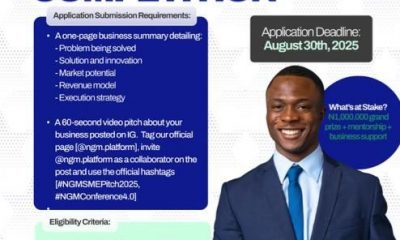

news7 months agoPitch to Win ₦1M! Apply Now for SME Competition 4.0

-

news7 months ago

news7 months agoApply Now: Pivot Challenge 2025 – Up to ₦50 Million Grant & Business Support for Young Nigerian Entrepreneurs

-

news7 months ago

news7 months agoApply Now: 2025 NNPC/SNEPCo Scholarship Worth ₦250,000

-

news7 months ago

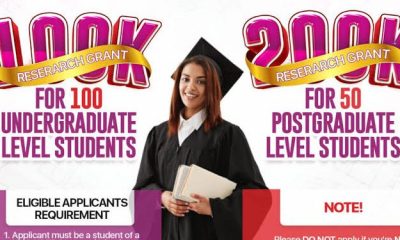

news7 months agoApply Now: Grooming Centre ₦20M Grants for Nigerian Undergraduates & Postgraduates

-

business8 months ago

business8 months agoFG Approves Policy Allowing Ministries to Approve PPP Projects Under ₦20 Billion

-

news7 months ago

news7 months agoApply Now: GET Compass Grant Program – Up to ₦150 Million for Nigerian MSMEs